- Africa is witnessing a significant upswing in cryptocurrency use, with a 25-fold increase since 2021 due to financial challenges.

- The continent’s lack of banking infrastructure and high transaction costs create a fertile ground for crypto solutions.

- Emerging markets like Africa are becoming incubators for innovative blockchain applications, with potential global impact.

- Decentralized financial solutions are poised to benefit small businesses and individuals by reducing cross-border transaction fees.

- Historical patterns suggest that emerging markets often drive technological advancements, and Africa is positioned for similar breakthroughs in crypto.

- The future of cryptocurrency will depend on regulatory initiatives and grassroots innovations working in harmony.

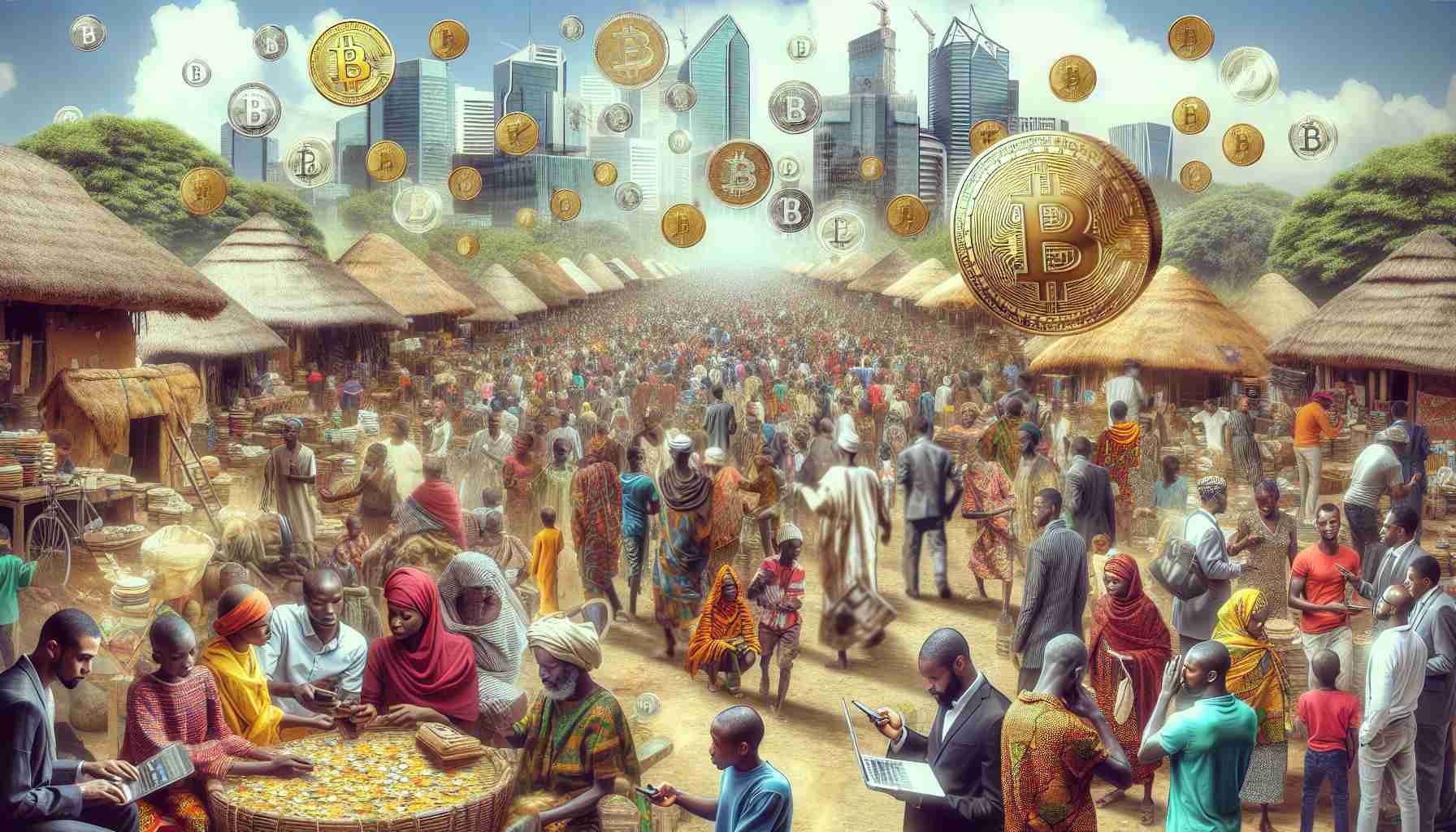

Africa is experiencing a financial renaissance, fueled by challenges that have made traditional banking inaccessible for many. With a staggering 25-fold increase in cryptocurrency adoption since 2021, this continent is at the forefront of the digital currency movement. The absence of banking facilities, high transaction costs, and rampant inflation have created a fertile ground for crypto to expand its foothold.

As pro-crypto leadership takes shape in Washington, regulatory changes may soon make digital currencies more accessible in the U.S. However, the real game-changer lies in emerging markets like Africa, where innovators are beginning to see opportunities rather than obstacles. In places where financial systems struggle, the potential for decentralized solutions shines brightly.

Imagine a world where cross-border fees are slashed, making every transaction smoother and more affordable. In this scenario, small businesses and individuals can thrive without the burden of excessive charges that drain their resources. The urgency for financial solutions in Africa is propelling developers to craft unique applications of blockchain technology, ultimately setting the stage for global crypto advancements.

History reveals that emerging markets often spark technological breakthroughs; think of how renewable energy scaled in off-grid communities. Similarly, as Africa tackles its pressing financial issues, it’s poised to become a laboratory for cryptocurrency innovation that could inspire worldwide change.

The future of crypto hinges on embracing both regulatory progress and grassroots movement in tandem. From the bustling streets of Nairobi to the halls of Washington, the global narrative of cryptocurrency is being rewritten, and Africa is leading the charge. Embrace the transformation – the crypto revolution is not just coming; it’s already here!

Unlocking the Future: How Africa is Paving the Way for the Crypto Revolution

Africa’s Financial Renaissance Through Cryptocurrency

Africa is undergoing a notable financial transformation, driven by challenges that have made traditional banking less accessible. With a remarkable 25-fold increase in cryptocurrency adoption since 2021, the continent is emerging as a leader in the digital currency landscape. Factors such as a lack of banking infrastructure, excessive transaction fees, and hyperinflation have created a perfect environment for cryptocurrencies to flourish.

Innovations and Features of Crypto Adoption in Africa

The surge in cryptocurrency usage in Africa is accompanied by various innovations. Notably:

– Decentralized Finance (DeFi): Many African countries are leveraging DeFi platforms to offer financial services without intermediaries, enabling users to borrow, lend, and trade seamlessly.

– Mobile Platforms: With a high mobile penetration rate, African users are utilizing mobile wallets and apps to transact in cryptocurrencies, making access easier than ever.

– Blockchain Solutions: Various startups are introducing blockchain technology to enhance supply chain management, land registries, and even identity verification.

Market Trends and Predictions

The momentum surrounding cryptocurrency in Africa is expected to continue. Analysts predict that by 2025, the cryptocurrency market in Africa could triple in size, fueled by:

– Increased internet access leading to higher mobile and digital engagement.

– An influx of foreign investment, as global companies recognize Africa’s potential in the crypto space.

– Local innovations in financial technology that are tailored to meet the needs of African consumers.

Pros and Cons of Cryptocurrency in Africa

Pros:

– Accessibility: Cryptocurrencies provide access to financial services for the unbanked population.

– Lower Transaction Fees: Digital currencies significantly cut down costs associated with remittances and international transactions.

– Economic Empowerment: Small businesses can thrive without the barriers posed by traditional banking.

Cons:

– Regulatory Challenges: The legal status of cryptocurrencies is still uncertain in many regions, creating risks for investors and users.

– Volatility: Cryptocurrencies are known for their price fluctuations, which can be daunting for new users.

– Security Risks: Growing cases of scams and hacking in the crypto space pose a threat to users’ investments.

Key Questions About Crypto in Africa

1. What are the main drivers of cryptocurrency adoption in Africa?

– The high levels of unbanked populations, high transaction fees from traditional banks, and the need for efficient cross-border payments are significant drivers for cryptocurrency adoption across the continent.

2. How is the regulatory landscape evolving for cryptocurrencies in Africa?

– While some African countries have embraced cryptocurrencies, others remain skeptical. However, there is a growing trend towards establishing clearer regulations to foster innovation while protecting consumers.

3. What role does technology play in enhancing crypto access in Africa?

– Technology, particularly mobile solutions, plays a crucial role in making cryptocurrencies accessible. The rise of mobile wallets, for instance, allows users to transact without needing a traditional banking setup.

For further information on cryptocurrencies and financial technologies in Africa, visit Forbes, Business Insider, or BBC News.