- Rocket Lab USA is a prominent player in the space industry, specializing in small- to medium-sized orbital rockets.

- The Electron rocket, a key innovation, is highly efficient, with 60 successful launches and 210 satellites deployed.

- The company has major clients like NASA and the U.S. Space Force, signaling strong industry ties.

- Revenue growth has been significant, from $62 million to $436 million over three years, highlighting adaptability in a volatile market.

- Key future projects include NASA’s Mars mission and launching a satellite constellation for IoT provider Kinéis.

- Rocket Lab’s upcoming Neutron rocket aims to handle larger payloads by 2025.

- Analysts project a 42% revenue CAGR through 2027, with positive EBITDA and GAAP earnings expected soon.

- With a strategic focus on growth, Rocket Lab represents a speculative investment opportunity with high potential.

Nestled among the stars of the space industry, Rocket Lab USA has emerged as a shining beacon for those with an eye toward the cosmos. Bucking the trend of many SPAC-fueled flameouts, this tenacious company is charting its own course, defying gravity and investor caution alike with its promise of breakthroughs in the small- to medium-sized orbital rocket arena.

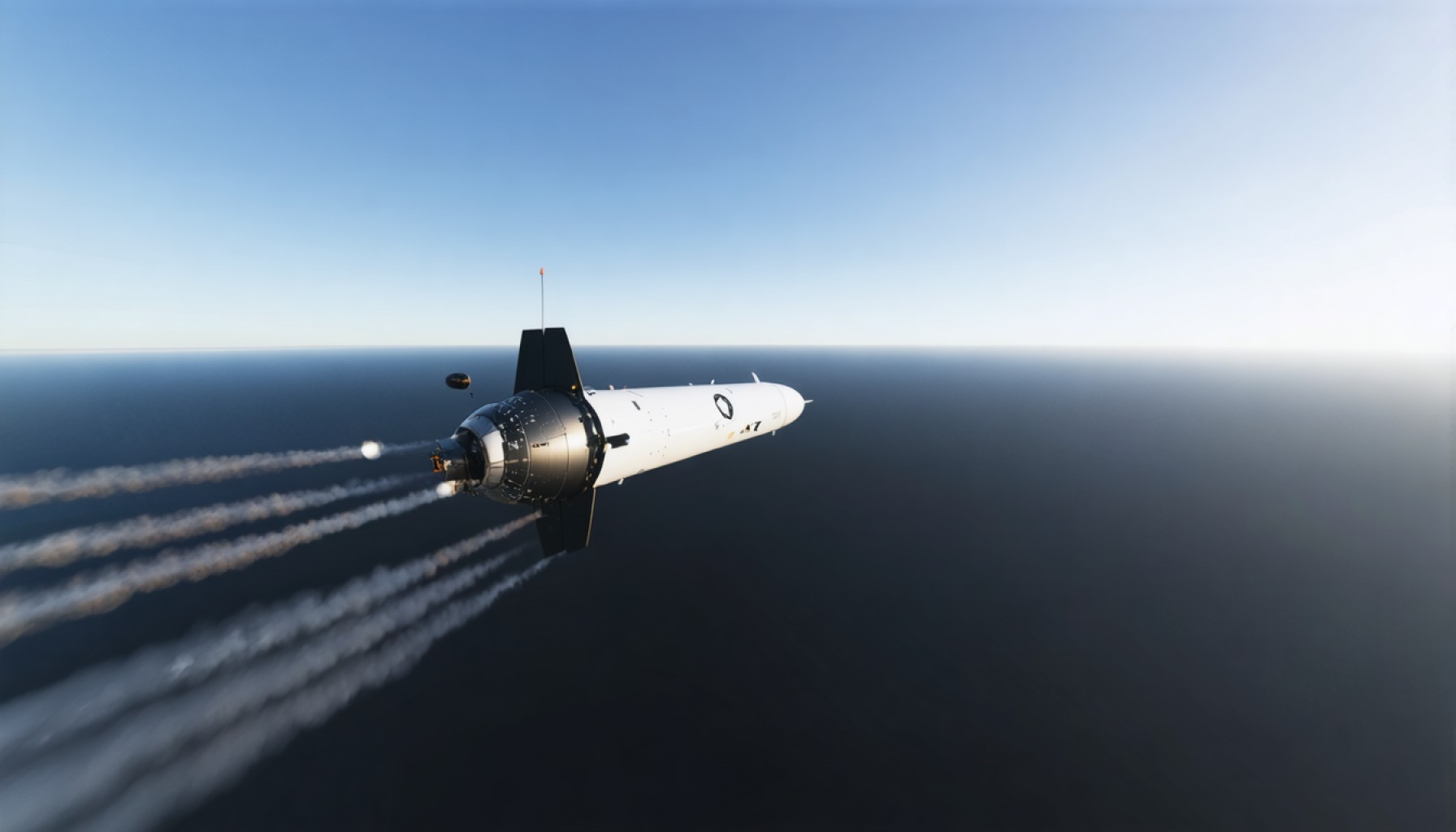

Imagine a rocket streaking across the sky, its mission: to deploy payloads that are seemingly minuscule compared to those launched by industry giant SpaceX. This is Rocket Lab’s Electron rocket, a marvel of efficiency and innovation that lifts up to 300 kilograms into the vastness beyond. Since its inception, Electron has achieved 60 successful launches, sending 210 satellites to the heavens from its trio of steadfast launch pads. With clientele like NASA and the U.S. Space Force in its corner, Rocket Lab isn’t just launching spacecraft; it’s launching its own destiny.

The genius of Rocket Lab lies in its adaptability. Over the past three tumultuous years, its annual revenue catapulted from a modest $62 million to an impressive $436 million. While the fiscal tides have been turbulent, with adjusted EBITDA margins fighting to break the surface, the company’s ambitions remain unwavering. By expanding its higher-margin space systems division, Rocket Lab aims to stabilize the financial turbulence caused by its launch services.

The future glows brightly with opportunities for Rocket Lab. With contracts in hand for NASA’s next Mars mission, dealings to launch a constellation of satellites for IoT connectivity provider Kinéis, and a fascinating role in U.S. national defense projects, Rocket Lab’s calendar is packed with promise. And the Neutron rocket — poised to handle payloads ten times heavier than Electron — stands ready to propel Rocket Lab to new heights come 2025.

Looking ahead, the numbers paint an alluring picture. Analysts predict Rocket Lab will see its revenue soar at a compound annual growth rate of 42% by 2027. In this high-stakes race toward profitability, Rocket Lab aims to achieve positive adjusted EBITDA and GAAP earnings in the next few years. With its liquidity as a solid foundation and a strategic focus on growth, Rocket Lab could blossom into a force capable of taking on more significant payload sizes, making it a tantalizing speculative investment.

For investors who thrive on a mix of stardust and risk, Rocket Lab offers a compelling narrative. Its vision extends far beyond the confines of Earth’s gravity, with potential growth that paints an audacious picture of the future. By 2045, if Rocket Lab holds its course, the company could evolve into an industry titan worth its weight in gold.

In a world where financial certainties are rare, and the mysteries of the universe beckon from above, Rocket Lab USA stands as a testament to innovation, foresight, and unrelenting ambition. Whether it ultimately reaches the lofty peaks of its projections or not, its journey offers a rare glimpse into the exciting, burgeoning world of reusable orbital rockets. For those willing to dream big — and stomach volatility — Rocket Lab may just be the ticket to a future filled with possibilities as vast as space itself.

Rocket Lab USA: The Rising Star Revolutionizing Space Industry Investment

Overview of Rocket Lab’s Achievements and Vision

Rocket Lab USA has carved a niche in the competitive landscape of the space industry by primarily focusing on small- to medium-sized orbital rockets. With a steadfast commitment to innovation and flexibility, the company has successfully positioned itself as a leader in launching smaller payloads more efficiently than its larger competitors.

Additional Insights and Unexplored Facets

Real-World Use Cases

1. Electron Rocket: The Electron rocket, known for its efficiency in small payload launches, has seen 60 successful missions, positioning Rocket Lab as a reliable partner for organizations like NASA and the U.S. Space Force. The Electron is designed to lift payloads up to 300 kilograms, ideal for satellite deployment, research missions, and commercial applications.

2. Neutron Rocket: Scheduled for deployment by 2025, the Neutron rocket is set to handle payloads up to ten times heavier than Electron. This expansion is vital for accommodating larger satellites and more complex missions, potentially offering a cost-effective solution compared to larger industry players.

Market Forecast and Industry Trends

– Growth Trajectory: Rocket Lab is expected to experience a 42% compound annual growth rate in revenue by 2027. This expected growth is driven by increased demand for satellite deployment, space exploration, and defense-related launches.

– Financial Health: Despite initial turbulence in achieving positive adjusted EBITDA margins, Rocket Lab’s strategic expansion into higher-margin space systems could stabilize its financial performance in the near future.

Security, Sustainability, and Controversies

– Sustainability Initiatives: As the space industry grapples with sustainability, Rocket Lab’s efforts to develop reusable rocket stages could significantly impact reducing the ecological footprint of space launches.

– Security and Defense Contributions: Partnerships with entities like the U.S. Defense Department highlight Rocket Lab’s integral role in national security, showcasing the dual-use nature of space technology for commercial and defense purposes.

Competitor Analysis and Comparisons

– SpaceX vs. Rocket Lab: While SpaceX focuses on large payloads with its Falcon rockets, Rocket Lab’s competitive edge lies in catering to smaller payloads, offering more frequent and cost-effective launches. This makes Rocket Lab an attractive option for companies with budget constraints or niche requirements.

Actionable Recommendations

For investors considering a stake in Rocket Lab, here are some quick tips:

1. Analyze Market Trends: Monitor developments in satellite technology and emerging markets needing low-cost, efficient satellite launches, which are core to Rocket Lab’s business.

2. Diversify Investment: While Rocket Lab offers promising growth potential, diversifying investments across various sectors can mitigate risks typically associated with high-volatility stocks.

3. Stay Updated on Technological Advancements: Keeping abreast of Rocket Lab’s innovations, particularly in reusable technology, could provide insights into future cost efficiencies and market positioning.

For more information about Rocket Lab and developments in the space industry, visit the official Rocket Lab website.

By staying informed and considering these factors, investors and enthusiasts can better understand Rocket Lab’s role and potential in the ever-evolving space industry.