Analyzing the Real Estate Landscape

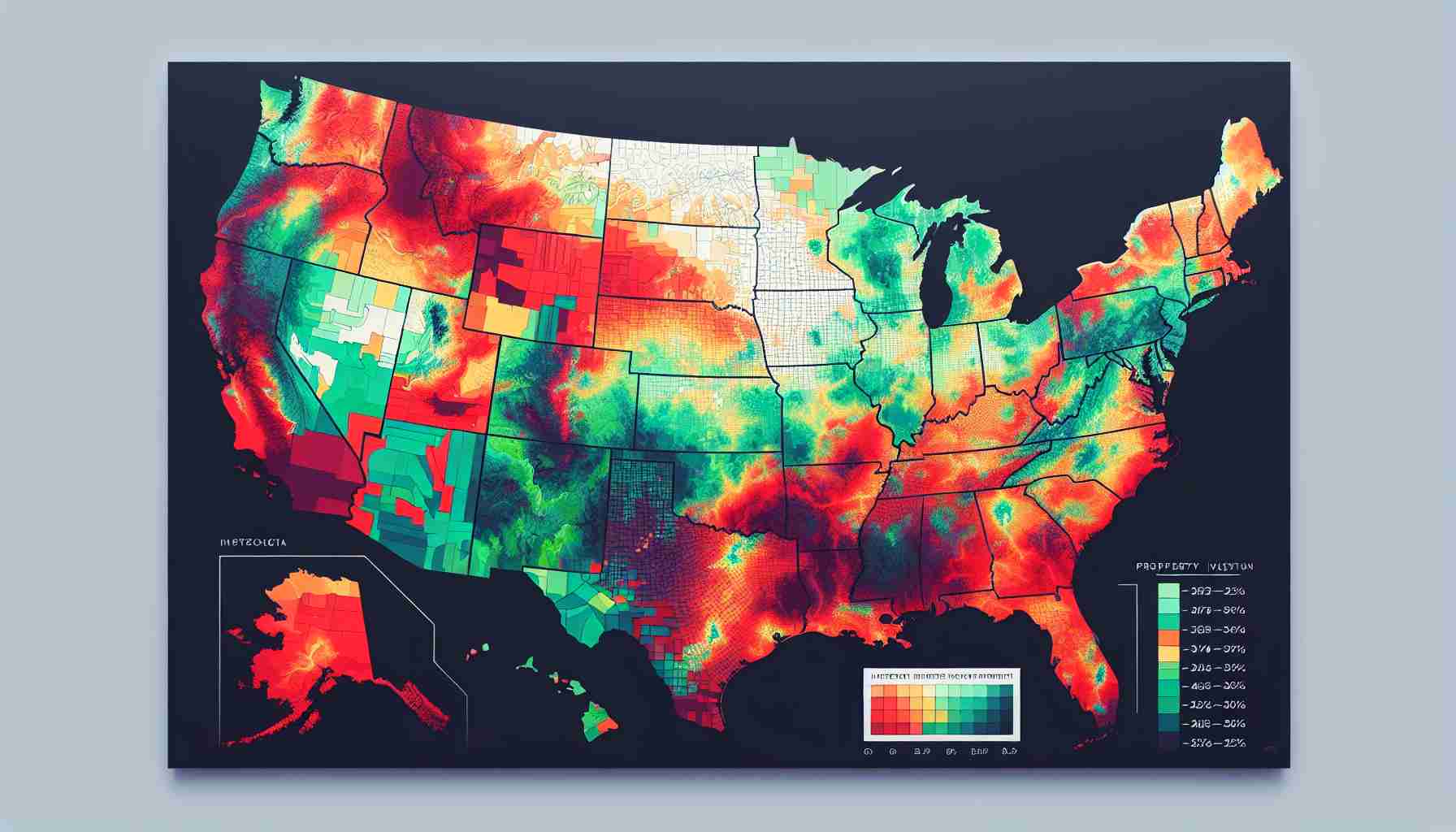

A recent evaluation by SoCal Home Buyers has shed light on which states offer the most lucrative opportunities for property investment. By examining various indicators such as median home prices, rental yields, effective tax rates, and cost of living, they produced a comprehensive investment score for each state.

The findings reveal that Louisiana ranks as the top state with an impressive investment score of 93.65. With a median listing price of $279,997 and a rental yield of 2.06%, it stands out for its affordability and low property tax rate of 0.62%. The cost of living index is also favorable at 92.1.

West Virginia follows closely, scoring 93.43. The state boasts a median home price of $242,450 and offers one of the highest rental yields at 2.50%, along with a minimal property tax rate of 0.49%.

Mississippi, North Dakota, and Oklahoma also make the cut as strong contenders for property investing, with scores ranging from 89.81 to 91.76.

Conversely, the analysis highlights Massachusetts as the least favorable state for investment, with an alarming median price of $817,475 and a dismal rental yield of 1.66%, earning a mere score of 35.30. Other states like Hawaii and California also feature low investment scores due to high costs and inadequate rental returns.

In summary, optimizing your property investments relies heavily on state selection—knowledge is power!

Unlocking Profitable Real Estate Investments: Which States Reign Supreme?

Analyzing the Real Estate Landscape

Investing in real estate can be a lucrative venture, but it highly depends on where you choose to invest. A recent evaluation by SoCal Home Buyers has provided a detailed look at the states in the U.S. that present the most promising opportunities for property investment. The analysis focuses on several key indicators such as median home prices, rental yields, effective tax rates, and cost of living, ultimately creating an investment score for each state.

Top States for Property Investment

Louisiana emerges as the frontrunner with an impressive investment score of 93.65. The state features a median listing price of $279,997 and a rental yield of 2.06%. With a low property tax rate of 0.62% and a cost of living index at 92.1, Louisiana proves to be a solid option for investors seeking affordability and returns.

Following closely behind is West Virginia, garnering a score of 93.43. With a median home price of $242,450 and an attractive rental yield of 2.50% alongside an only 0.49% property tax rate, West Virginia presents an appealing case for buyers looking for investment properties.

Other states that shine in this analysis include Mississippi with a score of 89.81, North Dakota at 91.76, and Oklahoma, showcasing competitive rental yields and affordable home prices.

The Least Favorable States for Investment

On the opposite end of the spectrum, Massachusetts ranks as the least favorable state for real estate investment with a score of only 35.30. The state has a staggering median home price of $817,475 and a rental yield of just 1.66%, making it a less attractive option for investors. Other states like Hawaii and California also report low investment scores largely due to high property costs and insufficient rental returns.

Key Investment Insights

– Market Analysis: Understanding the local real estate market trends is crucial. States like Louisiana and West Virginia not only offer lower prices but also sustainable rental yields.

– Tax Advantages: The favorable tax rates in areas like Louisiana and West Virginia can significantly enhance investment returns. Lower taxes mean more of the rental income is retained by the investor.

– Cost of Living: A favorable cost of living can attract potential tenants, which is vital for maintaining consistent rental income. States that score well on this metric present opportunities to minimize vacancies.

Pros and Cons of Investing in Each Region

Pros

– Affordable Investment: States like Louisiana and West Virginia offer real estate at lower prices compared to national averages.

– Higher Rental Yields: States with high rental yields such as West Virginia may provide faster returns on investments.

– Low Property Taxes: The lower tax burden enhances overall profitability.

Cons

– Market Fluctuations: Less populated states may experience more volatile market changes.

– Less Urban Appeal: Some top states for investment may lack major urban centers which can lead to fewer growth opportunities.

Conclusion

Choosing the right state for real estate investment is crucial for maximizing profits. Louisiana and West Virginia emerge as top contenders while Massachusetts, Hawaii, and California serve as cautionary examples for potential investors. Investors should weigh these factors carefully and stay updated on market trends to make informed decisions.

For more insights into real estate trends and opportunities, visit SoCal Home Buyers.